Nowadays, the hefty price tags associated with purchasing a vehicle outright make car loans indispensable tools for purchasing the vehicle we need. But whether you're a first-time buyer or looking to upgrade your ride, navigating the world of car loans can be overwhelming. But fear not! In this article, we'll explore:

- What is a car loan?

- Why someone would need a car loan?

- Where to get a car loan in Canada?

- What percentage is a good car loan interest rate in Canada?

- What factors affect someone’s car loan interest rate in Canada?

- What are the steps to finding the best car loan interest rate in Canada?

- Where Canadians can go to get a hassle-free car loan interest rate comparison?

What is a car loan?

A car loan is a financial arrangement where a lender provides funds to an individual to purchase a vehicle. In return, the borrower agrees to repay the loan amount plus interest over a specified period. This allows individuals to spread the cost of purchasing a car over time, making it more affordable.

Why would someone need a car loan?

There are several reasons why someone might opt for a car loan when purchasing a car:

- Affordability: Many individuals may not have the funds to purchase a car outright, making a loan the only viable option.

- Convenience: Car loans provide the convenience of acquiring a vehicle immediately without having to save for an extended period.

- Building credit: Successfully managing a car loan can positively impact one's credit score, making it easier to access credit in the future for other purchases.

- Flexibility: With various loan terms and repayment options available, car loans offer flexibility to suit different financial situations.

Where can I get a car loan in Canada?

In Canada, several types of car loans exist to cater to different needs:

- Traditional bank loans: Offered by major banks, these loans typically have fixed or variable interest rates and may require a down payment.

- Credit union loans: Credit unions often provide competitive rates and personalized service, making them a popular choice for many Canadians.

- Dealership financing: Car dealerships frequently offer convenient financing options through partnerships with financial institutions.

- Online lenders: With the rise of online lending platforms, borrowers can explore various loan options and potentially find competitive rates without leaving their homes.

What are good car loan interest rates in Canada?

Understanding what constitutes a good car loan interest rate is essential for making informed financial decisions. Generally, a good car loan interest rate is one that offers favorable terms and competitive interest rates. Here's what to consider when evaluating car loan interest rates in Canada:

- Interest rates: The interest rate on a car loan significantly impacts the overall cost of borrowing. As of 2024, typical car loan interest rates in Canada ranged from around 7% to 8%. A good car loan rate typically falls at the lower end of this spectrum.

- Loan terms: The loan term refers to the duration over which you'll repay the loan. While longer loan terms may result in lower monthly payments, they often come with higher overall interest costs. Conversely, shorter loan terms may have higher monthly payments but lower total interest expenses. Opting for a shorter loan term with a reasonable interest rate is generally preferable.

What factors may prevent you from getting a good car loan interest rate in Canada?

While securing a good car loan interest rate is the goal for most borrowers, several factors can hinder your ability to obtain favorable terms. Understanding these factors is crucial for identifying potential challenges and taking steps to address them. Here are some common factors that may prevent someone from getting a good car loan interest rate in Canada:

- Credit score: Your credit score plays a crucial role in determining the interest rate you qualify for. Generally, individuals with higher credit scores are offered lower interest rates, while those with lower scores may face higher rates or have difficulty obtaining financing. A good credit score (typically around 700 or above) can help you secure the most favorable car loan interest rates.

- Down payment requirements: Lenders may require a down payment as a percentage of the car's purchase price. A larger down payment reduces the amount borrowed and can lead to better loan terms, including lower interest rates. Aim for a down payment that's around 10-20% of the car's purchase price to secure favorable loan terms.

- Income and debt-to-income ratio: Lenders typically evaluate borrowers' income levels and debt obligations to assess their ability to repay the loan. A high debt-to-income ratio, indicating that a significant portion of your income goes towards debt payments, may signal financial strain and increase the perceived risk for lenders. Insufficient income or unstable employment history can also affect loan eligibility and result in higher interest rates.

- Vehicle age and condition: The age, mileage, and condition of the vehicle you intend to purchase can impact your loan options and interest rates. Lenders may have restrictions on financing older vehicles or those with high mileage due to increased depreciation and potential maintenance costs. To ensure you're keeping up with the repairs your older vehicle needs, you should look into purchasing an extended car warranty, a financial protection product that takes away the burden of large, unexpected bills that come with repairs and vehicle breakdowns. Discover if an extended car warranty is right for you here.

- Loan term: Opting for a longer loan term may seem appealing due to lower monthly payments, but it can result in higher overall interest costs. Lenders may offer less favorable interest rates for extended loan terms, especially for borrowers with weaker credit profiles. Shorter loan terms typically come with lower interest rates but require higher monthly payments.

- Loan amount: The amount you borrow relative to the vehicle's value, known as the loan-to-value ratio, can influence your loan interest rates. Borrowing a higher percentage of the vehicle's value may lead to higher interest rates or require additional collateral to secure the loan.

- Market conditions: Economic factors, such as prevailing interest rates and lender competition, can influence car loan rates. Monitoring market conditions and comparing rates from multiple lenders can help you identify good car loan offers.

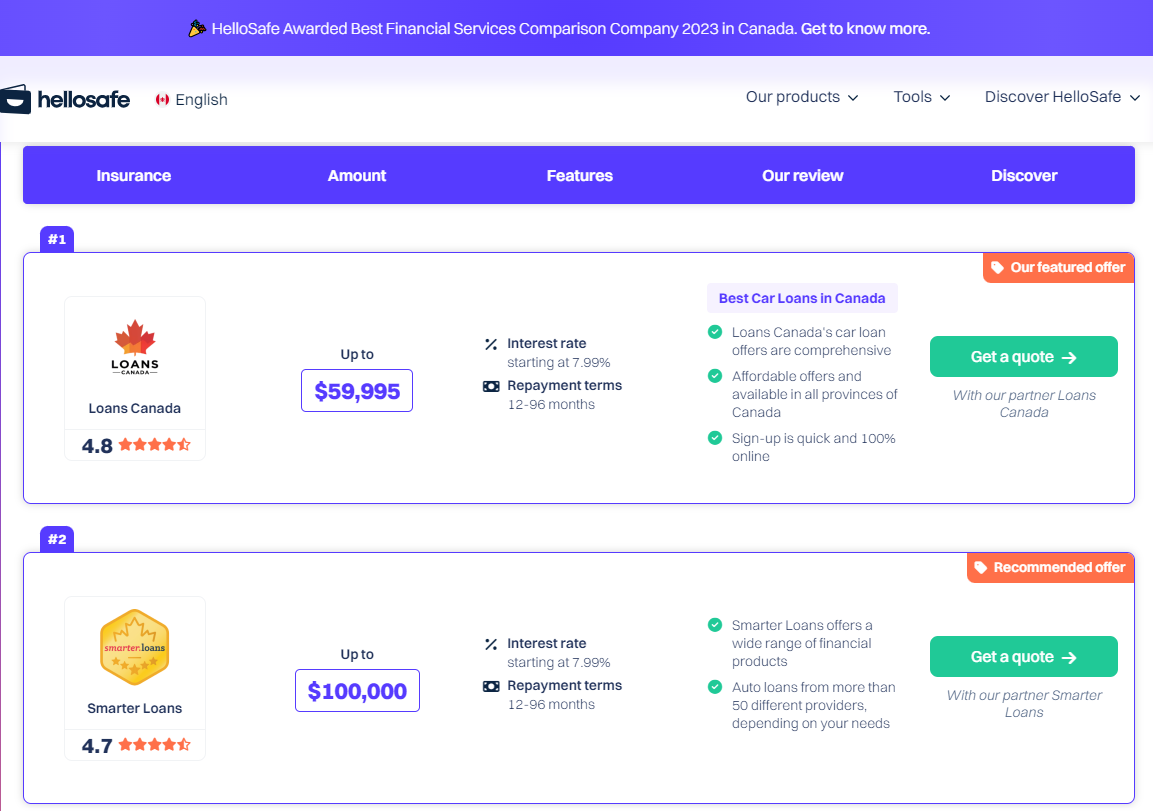

- Shopping around: Failing to compare interest rates and terms from multiple lenders can also prevent you from securing the best car loan interest rate. Each lender has its own underwriting criteria and may offer different interest rates based on your financial profile. Taking the time to shop around and negotiate with lenders can increase your chances of finding a competitive loan offer. HelloSafe, for example, is a free and convenient way for Canadians to compare car loan interest rates online.

How to find the best car loan interest rates in Canada:

Finding the best car loan interest rates requires careful consideration and comparison:

Step 1: Research and compare

Utilize online comparison tools to compare interest rates, terms, and fees from multiple lenders.

As mentioned earlier in the article, HelloSafe is the free online comparison tool that we recommend to Canadians for assessing the car loan interest rates available to them.

Step 2: Be prepared to negotiate

Don't hesitate to negotiate with lenders for better terms, especially if you have a strong credit history or are making a sizable down payment.

Looking for a hassle-free way to compare loan interest rates in Canada? Visit HelloSafe.ca.

Ultimately, a good car loan interest rate is one that aligns with your financial situation and goals, offering favorable terms, manageable monthly payments, and reasonable total interest costs. By considering these factors and conducting thorough research, you can find the best car loan rates in Canada that suit your needs.

For a hassle-free comparison of car loan rates in Canada, check out Hellosafe.

---

Buying a used car? Read more from GuardTree: